Taking your first step towards smart finance does not have to be so hard. You must aim to explore your options for getting a credit card in your early 20s as early as possible. A credit card that suits your needs can open a vast world of opportunities for you in more ways than you can realise. Being financially literate can transform your life.

If you talk to your peers, you will realise that few are thinking of getting their own credit card now. Most people don’t bother about a credit card too much or don’t use their own card for expenses. Obviously, it is not a competition but acting early aids your financial health.

Table of Contents

1. Build your credit score

When you spend with your credit card and repay your dues before or on the due date (before is better for your score than on the due date), it contributes positively to your CIBIL Score. This score is an indicator of a person’s credit summary or credit payment history. It primarily helps an individual during the loan approval process. The higher score you have (out of a maximum of 900), the easier it is for you to get a loan approved by a financial institution.

Whether you are looking at student loans for higher studies or just securing your prospects for a home/car loan sometime in the future your credit score will come into play. Even if you think you will never need it, preparing for a rainy day never hurts.

If you don’t have your own credit card, your personal score does not get built unless you have a pre-existing credit history in the form of loans.

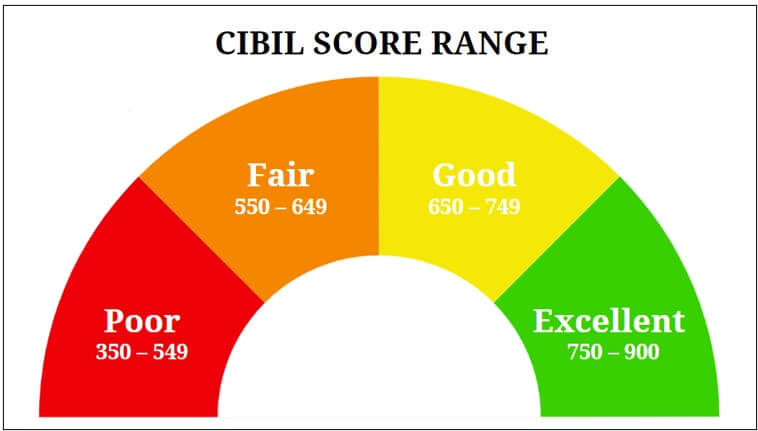

CIBIL Score Range

- NA/NH – ‘Not Applicable’ or ‘No History’ means you have no credit history since you have not taken any loan or credit in the past.

- Poor – Ranging from 350 to 549, a poor score is the result of late payment of credit card dues or loan installments. This hurts your chances of getting a further loan. It also indicates to the financial institutions that you are not a trustworthy customer and pose a threat to them by having an elevated risk of defaulting.

- Fair – A fair score between 550 and 649 indicates that you struggle to pay off your dues in time and are still untrustworthy. Financial institutions might agree to lend you credit but they will charge high rates of interest to offset their risk of defaults.

- Good – A good score that ranges from 650 to 749 signifies that you make timely repayment and can be trusted with credit. You can get loans at reasonable market rates but these will still not be the best rates. Continuing such good credit behaviour can help you further improve your score.

- Excellent – If your credit score lies between 750 and 900, it is an excellent score and is evidence of disciplined and regular repayments of EMIs or other dues. Banks hence consider you at minimal risk of defaults and will thus provide you with credit much more easily and at cheaper rates.

2. Safety in case of emergencies

If you ever run short of cash or are unable to make a transaction because of a lack of required funds at the moment of making the transaction, a credit card can come to your rescue. If there is a medical emergency, you do not have to wait for someone else to come to you for financial aid.

You can use your credit card and then pay off those dues before the end of the billing cycle of your card. The time gained allows you to arrange funds, for example when your salary gets credited within that period. This reduces your external dependency and often your need to borrow funds at a higher cost (because of interest).

However, one must be extremely cautious not to go too out of their way and max out their limits, especially if there is no possibility of arranging liquid funds soon to pay off the credit when it becomes due.

3. Discounts and offers

Usually, great deals and offers are available on all types of credit cards. The beginner cards have basic deals, cashback and discounts on clothing, food, electronics, travel, etc. but they become extremely lucrative as one moves closer to the premium cards. These premium deals sometimes even include airport lounge access or vouchers for luxury brands. Reward points collected over time can also fetch you offers that can be hard to come by through alternate methods.

Getting a card when you are young

If you do not have a regular income (eg: salary), you might face some difficulty in getting your first credit card. The issuing banks might not find a credit score available against your name which could make the highly vigilant issuer reject your application for a standard credit card. Read on to find out workable solutions for this.

If you still want to get accustomed to the process of using a card, you can ask your parent or another trusted adult to sign you up as an add-on holder to their card. While the credit score of the primary holder is the only one that gets affected, the add-on cardholder can avail of other benefits within the shared limits, resulting in minimal to no extra risk.

Another wonderful alternative is to get a secured credit card for yourself. This requires backing in the form of a deposit (eg: a fixed deposit) with the bank that will issue the card to the holder.

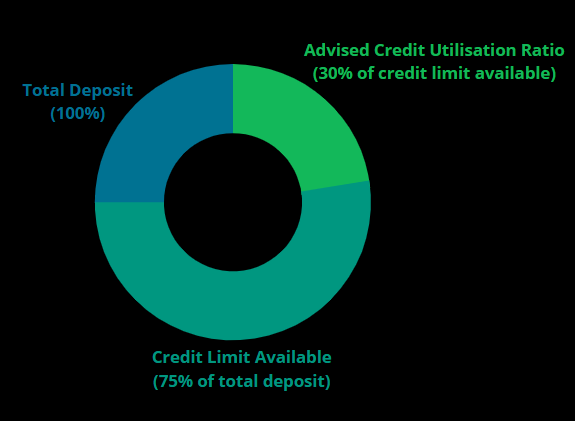

After the bank conducts its due diligence satisfactorily, it issues the credit card against the deposit which acts as the security or the collateral in case the holder cannot repay the dues. The credit limit on these cards is a percentage (usually 60-75%) of the deposit amount.

The application for such a card is quite like a standard card and you can ask the relationship manager at your bank to help you out with the same. Verification of identity, residence and workplace (in case you provide work details) is carried out soon after the application is submitted and the bank issues the secured credit card to the applicant within a few weeks.

This is a terrific way for young adults like college students or early working professionals to build a credit score and is instrumental in inculcating a sound financial discipline in the youngsters. The credit limit is also typically low on these cards (assuming making monumental deposits is not possible) hence reducing the risk involved for both the bank and the cardholder significantly.

Things to be careful of when you get your credit card

While getting a credit card early can be a good thing for most people, if you are not careful, it could actually put you in a fix and yield the exact opposite of your desired result, creating much agitation.

- Set reminders on sites like Google Calendar or in your planner to prevent any delay in repayment of credit card dues. You can also use trackers like Cred to help with this.

- Periodically check the spending on your credit card to be mindful of your usage and avoid over-spending.

- Treat your credit card like cash and never spend more than the money you currently have (even if you can get it as a loan or credit).

- You do not want to max out your limits (try to not even be close to this) or have outstanding bills for too long as it can severely hurt your credit score.

- While getting your credit card, read the fine print carefully to be aware of all the terms and conditions so that ignorance cannot hurt you later.

Credit Utilisation Ratio

The credit utilisation ratio indicates the percentage of the total available credit that is being used. For healthy credit scores, it is advisable to use your available credit but keep the credit utilisation ratio below 30% at all times. So, if you make a huge payment using your credit card, try to repay the dues at least partially to bring down this ratio below this mark.

This involves the credit used on a revolving basis and available to you across all your credit cards. You can read about this in more detail here.